does cash app stock report to irs

Boosts is a new feature that lets you save. You could get paid early by direct depositing your government benefits.

Pin By Dominique Rogers On Organize Life In 2021 Tax Deductions Property Tax Being A Landlord

Reporting expenses for student living with you.

. Cash App Investing does provide an annual 1099-B when you sell stock during a given tax year. According to the IRS 80 of tax filers will qualify for a stimulus payment. But chasing down deals from different cash back apps can be less enjoyable.

The determination of basis in these situations is beyond the scope of the VITATCE programs. Choose if youd like to sell in dollars or shares using the drop-down menu. In determining capital gain or loss your basis is the amount you paid when you exercised the option plus the amount.

The Composite Form 1099 will be available to download using your Cash App on or after March 1st. If you had income from crypto whether due to selling. Borrowing money allows the ultrawealthy to earn minuscule salaries avoiding the 37 federal tax on top incomes as well as avoid selling stock to free up cash bypassing the 20 top capital gains.

Bitcoin IRA does not list fees on its site but third-party sources indicate that the company charges a one-time fee of 10 to 15 of the initial investment a 240 annual custodial account fee a. New York Stock Exchange. With a Form 1040 you can report all types of income expenses and credits.

We urge people who havent received a payment date yet to visit Get My Payment again for the latest information IRS Commissioner Chuck Rettig said in a statement. The Get My Payment app went offline during brief periods over a few days for planned maintenance and on April 26 the IRS announced significant enhancements to the app. A Bitcoin IRA is another name for a self-directed IRASelf-directed individual retirement accounts allow you to invest in.

Income Capital Gain or Loss 10-3 Adjusted Basis An adjustment to basis may include additional commissions or fees paid to the broker at the time. If you have received a notification that your stimulus payment has been deposited on your Turbo Visa Debit Card you can access it by simply logging in to your account. The IRS Is Behind On Processing More Than 55 Million Tax Returns As Oct.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 230405 of this chapter or Rule 12b-2 of the Securities Exchange Act of 1934 24012b-2 of this chapter. What is Cash Boosts. Slide is a cash back app that promises just that.

For the year of the sale or other disposition of the stock. Clothing and household items not in good used condition. Reported to the IRS Holding period.

Previously the IRS offered different types of Form 1040 the 1040A and 1040 EZ. Youll get basic functionality for example on the charts. How do I calculate my gains or losses and cost basis.

The Internal Revenue Service is a proud partner with the National Center for Missing Exploited Children. Common Stock 100 par value per share. Stock grants often carry restrictions as well.

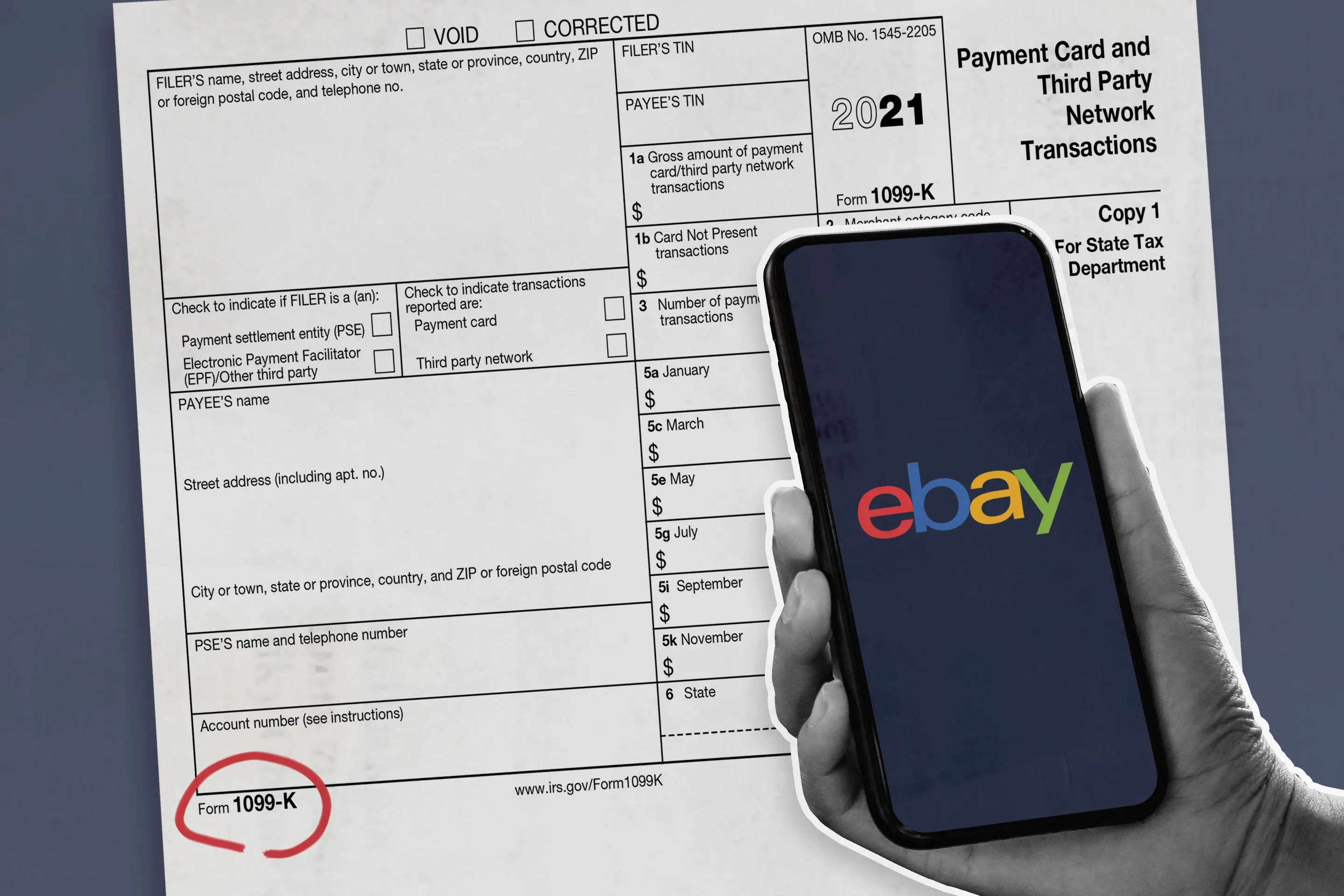

This will also be reported to the IRS which is required by law. Current tax law regardless of the new rule requires anyone to pay taxes on. In 2020 the IRS rolled out the 1099-NEC to report money they paid to people who did work for them but werent employees.

The IRS said it would host a webinar about stimulus check payments starting at 2 pm. Here are the new 1040 form instructions as of 2019 from the IRS. ESOP and does not know the basis of the stock refer them to a professional tax preparer.

This applies to everyone who must file taxes. You must include all cash winnings and the fair market value of non-cash winnings as taxable income. What if you could use a single cash back app to enjoy a high cash back rate on every purchase.

The IRS is looking for those who use cash apps as a way to circumvent banks and traditional forms of income reporting. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. Does Cash App report to the IRS.

In other words if you freelanced were self-employed or had a side gig. As the name implies RSUs have rules as to when they can be sold. Since casinos race tracks fantasy sport websites and other places of gambling are heavily regulated by the IRS they are required to report your winnings on Form W-2G.

Lets take a closer look at what. What Is a Bitcoin IRA. Easement on building in historic district.

When the IRS starts investigating oops isnt going to cut it. ET on Thursday April 23 and there would be a live QA session online. Cash App Investing is required by law to file a copy of the Form Composite Form 1099 to the IRS for the applicable tax year.

Emerging growth company If an emerging growth. Will the IRS receive a copy of my Composite Form 1099. Dont accidentally write a 3 instead of an 8.

Cash App offers a bare-bones setup if youre clicking onto a stock to see more. The independent registered public accounting firms report on the financial statements included in the Companys Annual Report on Form 10-K for the year ended December 31 2020 contained an explanatory paragraph regarding the Companys ability to continue as a going concern. New Form 1040 Instructions.

As of the date of this report the Companys current cash balances together. Click Sell in the order window on the right side of the screen. Report the capital gain or loss as explained in the Instructions for Schedule D Form 1040.

The IRS has put a question about cryptocurrency holdings on page one of 2020 tax returns that taxpayers are expected to answer accurately. The IRS usually taxes those winnings at a flat 25 rate rather than at your income tax withholding rate. However the IRS postponed the event though it could be rescheduled with a future date to be determined Use the IRS Portal and Get My Payment App.

There has been a flurry of furious cash app users this past week angrily responding to rumors of President Joe Bidens new tax reporting plan requiring taxpayers to report all Venmo and cash app income over 600. Navigate to the stocks detail page. When you sign up for Cash App you must fill out a W-9.

Here you can find the stocks historical performance analyst ratings company earnings and other helpful information to consider when selling a stock. The 1099-B will list any gains or losses from those shares. The app offers 4 cash back on purchases without any rotating offers to keep track of.

Cash contributions and out-of-pocket expenses. How your stock grant is delivered to you and whether or not it is vested are the key factors. Do you need FAST access to government benefits or payroll.

Total deduction over 500.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Coinbase Report To The Irs Zenledger

Don T Believe The Hype Biden S 600 Tax Plan Won T Force You To Report All Venmo Transactions To The Irs

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Cash App Tax Forms All Tax Reporting Information With Cash App

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Nowthis If You Are Doing Business With Your Clients Using Third Party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

Fillable Form 1040 2018 Income Tax Return Irs Taxes Irs Tax Forms

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

New Irs Rules For Cash App Transactions Start Next Year Ohio News Time

Why Some Payments Through Cash Apps Will Need To Be Reported To The Irs California News Times

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

How Much Can You Send On Venmo Best Finance Apps Finance App Finance Apps

Camscanner Understanding Encouragement Scanner App

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Biden S 80 Billion Plan To Boost Irs Audits May Target Small Businesses

Cryptocurrency News Crypto And Visa Pay With Crypto Irs 1040 Crypto Question Cryptocurrency News Visa Visa Card